As a firm with offices in Columbus, Ohio and Naples, Florida, we have a large number of clients who travel south for the winter. Many of those who now live in Naples full time, typically started off vacationing in Florida for a few weeks, then talked themselves into foregoing the Ohio winters, and ultimately decided to leave the Buckeye state for good.

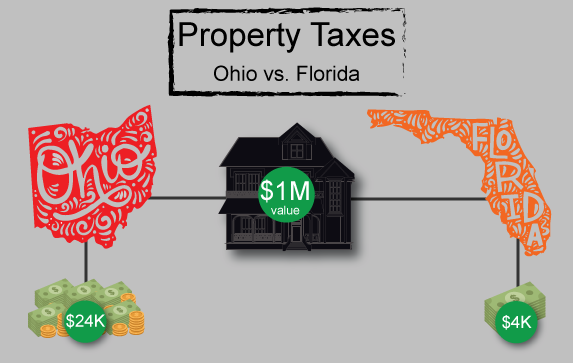

If you are considering moving to Florida, it’s important you consider the impact it could have on your long-term financial plan. The main reason for the property tax discrepancy, in this case, is due to a difference in the “assessed value” of each home. This can lead to noticeable differences in property taxes between homes in similar areas.

Consider this comparison:

I reviewed two homes from Collier County, Florida, with each currently listed for sale at the $1M mark. Both houses are located in respectable school districts.

House #1*

- A larger home of 5,400 square feet

- The homeowner paid $4,491 in property taxes last year, or approximately 0.45% of the market value

House #2*

- A smaller home of 1,400 square feet and is located directly on the water

- The homeowner paid $7,105, or approximately 0.71% of the market value

I compared the two Florida homes to similar-sized homes in Franklin County, Ohio that are also on the market for $1M. Both of these properties are located in desirable school districts as well.

House #1*

- A 3,600 square foot home that is located directly on the water

- The homeowner paid $16,343, or 1.63% of the market value of their home

House #2*

- A larger home of 4,200 square feet, near a prestigious golf course

- The homeowner paid a whopping $20,188 last year, just more than 2.1% of the market value of their home

This leads me to the impact property taxes can have on a portfolio in retirement. If we compare the Ohio and Florida homes with the largest property tax discrepancy, we notice an annual cost savings of $15,697 for living in Florida. Assuming a portfolio will generate 8% per year and inflation will average 3% per year; a retiree who stays in Ohio would need an additional $314,000 of after-tax retirement savings just to endow their property taxes. I should note, this example ignores any potential tax deductions for property taxes paid, which could help the argument for staying in Ohio, but not significantly.

Like most financial decisions we counsel clients on, there must first be a non-financial motivation. We don’t let tax decisions drive our investment philosophy, and you shouldn’t allow potential property tax savings to decide where you spend your golden years of retirement. There are several other trade-offs that must be considered when contemplating a move in retirement. In most cases, state and local governments will find a way to tap into your nest egg one way or another. While you may be saving a few bucks on property taxes, you are probably paying more in sales tax, income tax or both. You must also weigh the cost of insuring the property in one location versus another as well as the variance in utility costs.

*Property values based on current home listings from Zillow.com

*Property taxes obtained from the Franklin County Auditor’s Office in Ohio and the Collier County Auditor’s Office in Florida.