Now that Tax Day has come and gone, you might be wondering where all the dollars you just paid to Uncle Sam are spent. Laura Saunders recently wrote an article for the Wall Street Journal that addressed this. She utilized the “Taxpayer Receipt” report from the Committee for a Responsible Federal Budget, which is an independent, non-partisan and nonprofit group in Washington.

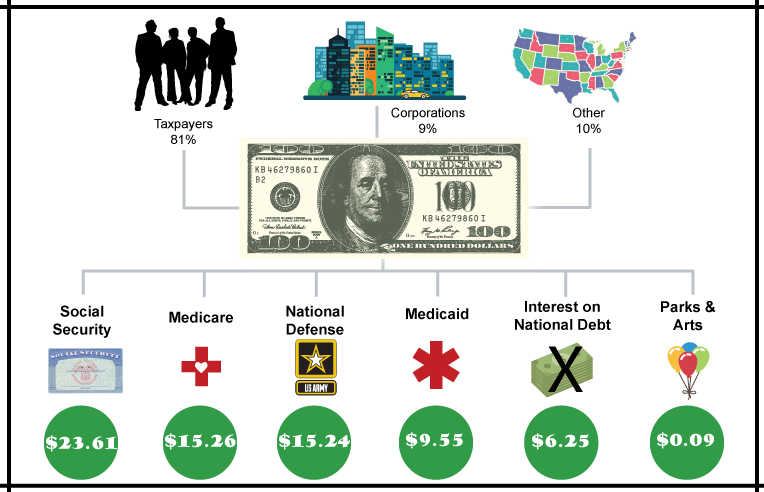

Most people could guess where a majority of the tax revenue dollars are allocated. For 2016, of every $100 in tax revenue collected, $23.61 went toward Social Security payments and another $15.26 went to Medicare. Medicaid, the health insurance program for the underprivileged, accounted for $9.55. The costs of those three programs account for almost half the tax revenue collected.

National defense was the third largest expense, at $15.24 per $100 of tax revenue collected, not counting Veterans benefits. Interest payments on the national debt required $6.25 of every $100 of tax revenue collected.

Taxpayers provided almost half of the $100 of tax revenue collected via the individual income tax. In total, taxpayers delivered 47% of the tax revenue. Additionally, payroll taxes accounted for 34% of the tax revenue. Corporate taxes only accounted for 9% of the revenue. The remaining 10% was generated by other sources, such as excise taxes.

Discretionary expenses and entitlement programs require a rather small portion of the tax revenue collected. Things like federal expenditures and grants for education ($2.08), food stamps ($1.89), affordable housing ($1.27) and foreign aid ($1.14) actually make up a very small part of the budget. Collectively, they cost a little more than the interest payment on the National Debt. There has been talk about reducing the budget by lowering expenditures on the National Park Service and the National Endowments for the Arts and Humanities, which together represent $0.09 of every $100 of tax revenue collected.

During 2016, the government had to borrow another $15.24 per $100 of revenue collected because expenses exceeded tax revenue collected. In 2011, we had to borrow $35.70 per $100 mainly due to stimulus funding programs instituted by government and lower tax revenue collected as the country was still emerging from the 2008 financial crisis. There has been an improvement, but as a country, there continues to be a considerable gap in running balancing the budget. This begs the question, what cuts would you make?