Because you’re an easy target. Not the answer you were hoping for? Don’t worry, because it’s probably not true. Many people incorrectly assume the amount of dwelling coverage (insurance for the structure of the home) listed on their homeowner’s policy is directly tied to the market value of their home. In reality, dwelling coverage is based on the size of the house and the average cost of construction in the area. The average cost of construction is often calculated by an estimating software that derives its data from local contractors and building material wholesalers. The software determines what the estimated cost would be to rebuild a home, assuming the following:

- The home is rebuilt with like kind and quality of materials and workmanship, within a reasonable time frame. (For those who have gone through the building process, don’t laugh too hard at the “reasonable time frame” comment.)

- Contractor profit and overhead, typically around 10% for each. (Again, no laughing)

- Architect, engineer and other “specialty” contractors for design and/or decoration.

- Cost of adhering to current building codes.

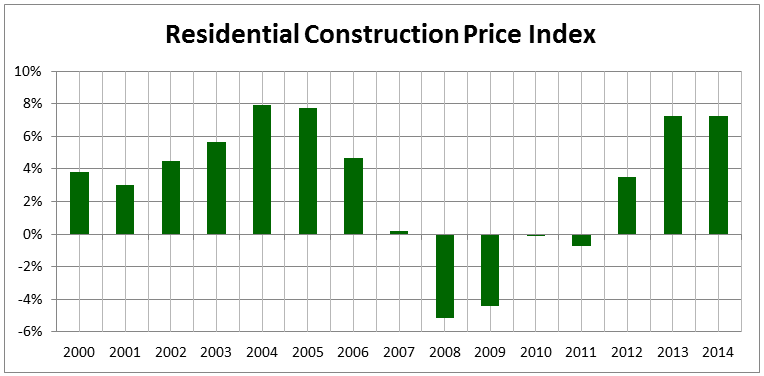

As you can see from the chart below, (based on U.S. Census bureau’s Price Index of Single-Family Houses Sold) construction costs have been somewhat volatile over the past 15 years and have increased significantly in the past four years.

If you have not reviewed your coverage with your insurance agent recently, you may be setting yourself up for a very unpleasant surprise. Also, if you have completed any major renovations or additions to your home, be sure to contact your agent to adjust your coverage as well.

As with most things in life, there can be a large difference in a policy when comparing insurance companies. While none of us anticipates a catastrophe, if you ever encounter one, you will not regret insuring with a quality company that includes some of the following less common benefits:

- Debris removal for damaged property

- Site preparation, which may be necessary to bring the condition of the land back to a state suitable for building

- Demand surge, which can often inflate the cost of materials and labor shortly after a natural disaster

- Code updates, which may increase the cost of construction in the future

- Overtime overages, which might be necessary to expedite construction and get you back in your home faster

Although it may be easier to keep an eye on the value of your home, it can be equally important to watch the coverage you have in place. Don’t jump to conclusions if your coverage increases. Rather, investigate the reason for the increase, and evaluate whether you need to take action.