One of my favorite aspects of being a financial planner is the opportunity to take objective facts and blend them with subjective assumptions to create solutions that will ultimately help clients, and their families, achieve a greater level of wealth.

Over the past few years – and I suspect for several years to come – the opportunity will continue to present itself as it pertains to the Roth conversion decision. When viewed in isolation, many investors and financial planners may choose to avoid an individual retirement account (IRA) conversions based on static assumptions about tax rates and taxable income; however, there are often instances where the same client would be foolish not to consider a Roth IRA conversion, depending on their tax assumptions and appreciation for flexibility. Below are 4 reasons I believe you should consider converting to a Roth IRA:

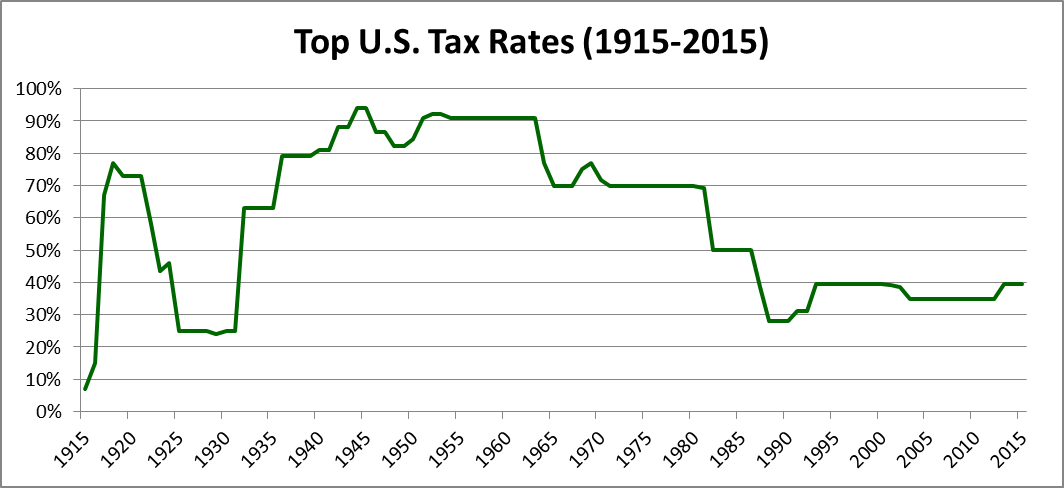

Current Tax Rates:

The chart below shows top federal income tax rates have been at a relatively low point since the 90s. Over the course of the past 101 years, there have been 63 years where top U.S. tax rates have been higher than our current top rate of 39.6%. If the top tax rates continue to stay low, like they have for the last 15 years, probabilities and rational thinking suggest that paying to convert a traditional IRA now, even at the highest federal tax rate, could save you the pain of paying much higher taxes in the future.

Source: https://www.irs.gov/uac/SOI-Tax-Stats-Historical-Table-23

Preferable Wealth Transfer Technique:

Legislatively, you are not required to take funds from your Roth IRA account during your lifetime. This is one significant difference between traditional IRAs and Roth IRAs and is also the main reason why a Roth IRA is often a preferred vehicle to transfer funds to heirs. If you are fortunate enough to be in a position to transfer accumulated wealth to the next generation, this retirement vehicle will allow you to transfer every dollar you contribute plus future growth, without the need to pay the tax man. Please note this statement assumes you are not subject to any state or federal estate taxes. The heirs of an inherited Roth IRA may continue to grow the assets tax-deferred over their lifetime and are subject only to Required Minimum Distributions (RMDs), which are based on their life expectancy.

Future Contribution Flexibility:

Converting an IRA account today could open the door to make more Roth IRA contributions in the future. I won’t go into the details in this article, but Jason Farris published an article on making “backdoor” Roth IRA contributions, which is a viable option for those who do not have large unconverted IRAs. Most often we see this opportunity for those who have the earned income that qualifies them for contributions, as well as the majority of their retirement savings in a 401(k), 457, 403(b), or other qualified plan that will not limit the tax-free benefit of future “back door” conversions.

Tax Flexibility:

Since the creation of the Roth IRA nearly 20 years ago, Congress has suggested a need to alter the tax-favorable nature of our beloved Roth IRA accounts; however, the fact that total contributions into this retirement vehicle eclipsed $500 billion in 2013 leads me to believe more than a few taxpayers would fight Uncle Sam on any such change. Even though they may face resistance, it is not hard to envision a scenario where Congress seeks to limit future contributions and/or conversions to Roth IRA accounts in the future. I find it less likely they would renege on the promises made to those already invested in such accounts. There may be different ways of growing retirement dollars on a tax-free basis in the future, but I wouldn’t count on it. The value of funding Roth IRA accounts while the door is still open is high in my mind. There is no way of knowing when this strategy may disappear in the future, so please contact your advisor if you feel this is a strategy of interest to you.

*If you would like to learn more about Roth IRA, and how to make back door contributions, read our other article.