Paying for college is a financial obstacle for many families. To accomplish this feat, most people have to start saving very early. Even if you started stuffing your little one’s piggy bank the day you arrived home from the hospital it may still not cover the steadily rising tuition costs.

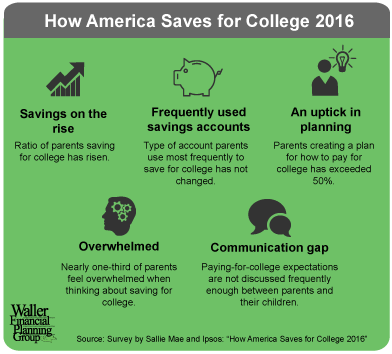

More parents are saving for college in order to provide their child with the best opportunity to pursue higher education. A national study by Sallie Mae and Ipsos – “How America Saves for College 2016” – found more parents are creating a plan to pay for college. The parents who plan to pay for college rose 51 percent in 2016, up 8 percent from 2015. The study also revealed the use of 529 college savings plans increased over a third from 2015 to 2016.

While most families worry about not saving enough for college – some have to consider their options when they saved more than they needed. It is a rare occurrence to have money left over from a 529 college savings plan. If you find yourself in this situation, you are very fortunate there are options available.

Graduate School

Many college graduates continue their education in post-graduate studies; however, 529 college savings plans are not limited to undergraduate education and can be used at any eligible educational institution. Most community colleges, public and private colleges, universities and vocational schools in the United States are eligible education institutions. To find out if a school is eligible, go to the Department of Education’s website.

Change the beneficiary

You can change the beneficiary on an account at any time, and there is no age restriction on the beneficiary (it is never too late for you to attend or go back). In order for you to avoid the beneficiary change being deemed a withdrawal, the new beneficiary must be a member of the family of the previous beneficiary.

Do Nothing (at least for a while)

It is perfectly fine for the account to remain unaltered for an extended time. You need to use the assets in the account or designate a new beneficiary within 30 years after the beneficiary graduates from high school or within 30 years after opening the account, whichever comes later. There are no time limitations for a beneficiary to decide on attending college, so take your time and reconsider the purpose of this account.

Take the Penalty

You can always simply distribute the money and use it for anything. What’s the trade-off? If the withdrawal is not for a qualified higher education expense, the earnings (the amount above what you deposited) will be subject to tax as ordinary income and a 10% withdrawal penalty. If you direct the withdrawal to the beneficiary by making the check payable to them, the beneficiary will be responsible for reporting the earnings – presumably keeping the income taxes lower.

Typically the goal is not to have excess money in your 529 college savings plan but rest assured there are options to consider. To learn more about 529 college savings plans, or if you would like to assess whether one might be beneficial for you, please contact us.