*This article was updated Jan. 2019

Now that we are immersed in having our 2018 income tax returns completed, let’s talk about what’s new for 2018. In December 2017, Congress passed considerable tax law changes. This piece of legislation is named the Tax Cuts and Job Act of 2017 (TCJA). Like many laws, there are plenty to like and dislike. This article is going to focus on some of the more common aspects of the TCJA, which are likely to impact the individual taxpayer. The TCJA is an extremely vast piece of legislation, focusing both on corporate tax law and personal tax law.

It is important to note that the personal tax law changes were enacted with a sunset provision, which means that the changes are only effective for a period of time (2018-2025). If TCJA is not made permanent by then, or another act is not passed, the changes sunset, and we revert back to the tax laws that were in effect in 2017 for 2026 forward.

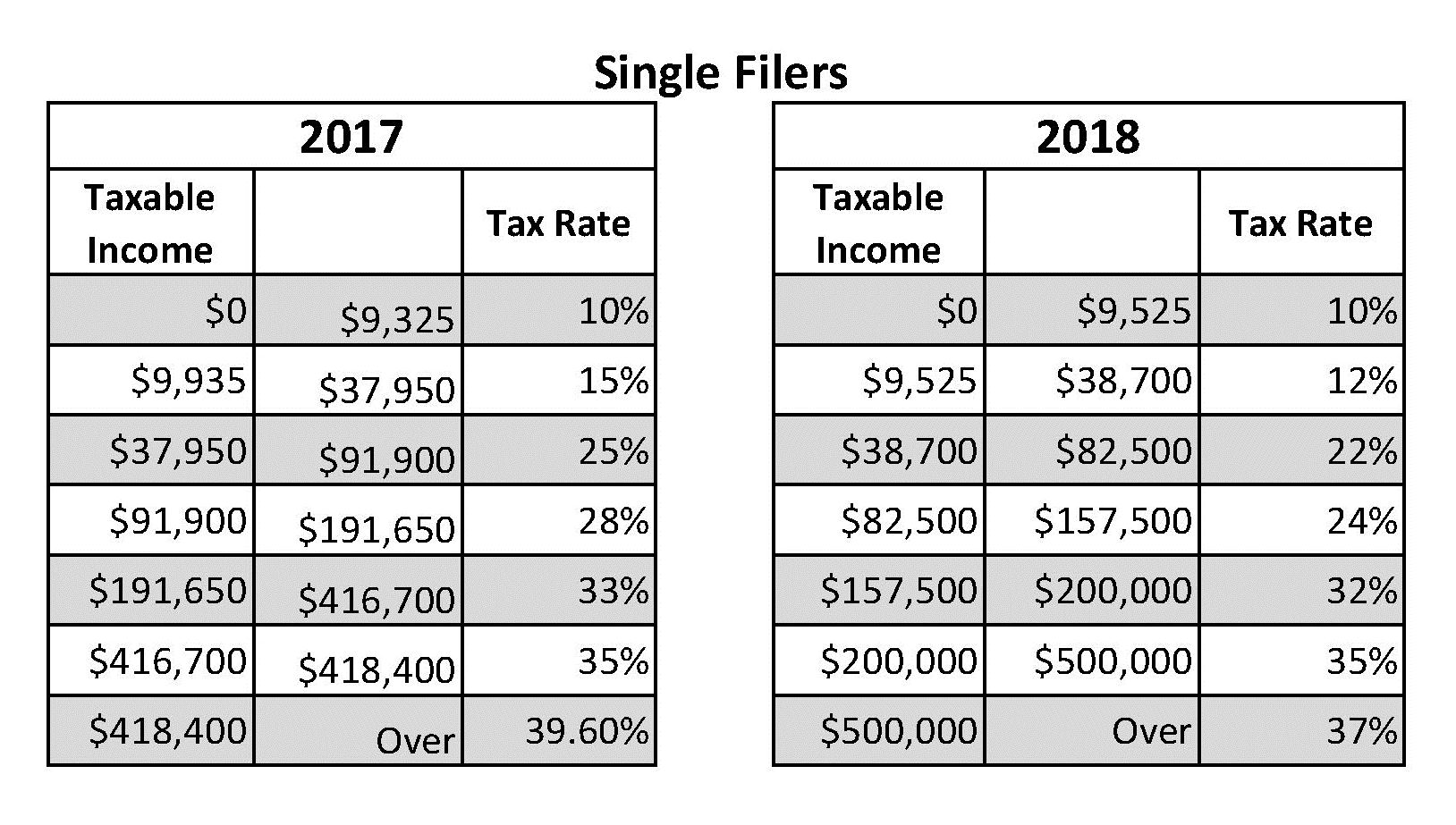

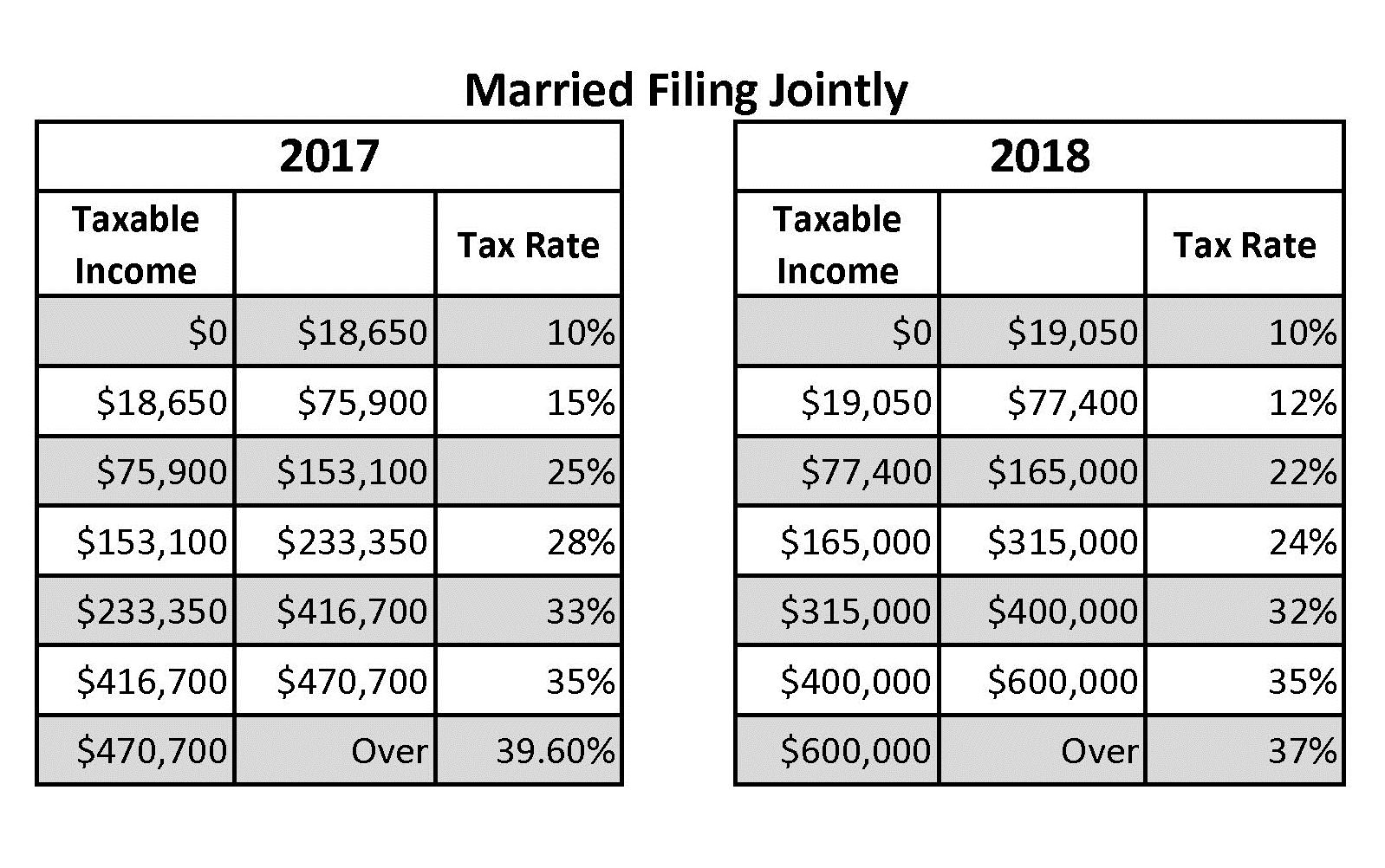

Tax Brackets

Under TCJA, there are seven tax brackets, which are lower than the previous seven tax brackets.

You probably noticed your net paycheck is more. That is because the new withholding tables are effective, and employers are withholding less. Additionally, the default tax withholding rate on bonuses or other supplemental income is now 22%. A word of caution: the 22% federal income tax withholdings may not sufficiently cover your federal income tax liability.

For example, imagine a situation in which the husband has taxable W-2 earnings of $85,000 and the wife has taxable W-2 earnings of $105,000, plus she receives a $25,000 bonus. The bonus will only have 22% withheld for federal income taxes, but the couple will be in the 24% bracket. Thus, they will likely owe more in income taxes when they file their return.

Deductions and Credits

A major aspect of TCJA was the removal and limitation on some popular itemized deductions and credits. One of the most significant removals is the personal exemption. In the past, the taxpayer and spouse, plus every dependent would receive a $4,050 exemption that would reduce taxable income. For a family of five, that amounted to a deduction of $20,250.

Another major change is related to deducting taxes paid. For anyone that itemized their deductions, one of the largest deductions typically is related to taxes you paid. This includes state and local income taxes and real estate taxes. Under TJCA, this deduction is capped at $10,000.

A third major change is also related to itemized deductions. The TJCA completely eliminated the deduction related to miscellaneous deductions. These included unreimbursed job expenses, tax preparations fees, investment fees, etc.

The TCJA made a beneficial change that will benefit those that make cash donations to charities. Previously, the charitable deduction was limited to 50% of your adjusted gross income (AGI). It has been expanded to 60%.

The standard deduction will be utilized by more taxpayers going forward due to the changes. This will simplify things for those taxpayers. The standard deduction increases to $12,000 for single filers from $6,350, and $24,000 for married filing jointly from $12,700.

The child tax credit was expanded to increase the number of taxpayers that will qualify. Under previous law, the child tax credit was $1,000 per dependent under the age of 17; however, it was phased out if your income was over $75,000 as a single taxpayer or $110,000 for a married couple. Going forward, the phase-out is increased considerably; It is $200,000 for single taxpayers and $400,000 for married taxpayers filing a joint return.

There is also a new provision that allows for a $500 credit for dependents who do not qualify for the child tax credit, which is also subject to the income phaseouts mentioned above. This will impact many older children that are still considered dependents, such as those that are pursuing higher education.

For 2018, the ability to deduct medical expenses under Schedule A for those that will be able to itemize their deductions is more expansive. The threshold for deducting medical expenses will be based on a 7.5% of AGI floor. For 2019 forward, it reverts back to a 10% of AGI floor.

Under TJCA, employer-provided moving expenses are now considered taxable income to the employee. Under previous law, employers could offer a payment to help offset the cost of an employee relocating that was not taxed.

New alimony agreements put in place in 2018 and later are treated completely different than before. Previously, the amount one ex-spouse paid to the other as alimony was an above the line deduction for the ex-spouse paying alimony and taxable income for the receiving ex-spouse. Going forward, the paying ex-spouse will not receive the deduction and the payment will not be taxable to the receiving ex-spouse. It is important to point out this does not affect agreements already in place; it only impacts new agreements or older agreements that are legally modified.

Estate and Gift Taxes

The amount of wealth that can be passed from one generation to the next received a drastic increase under TCJA. Previously, you could pass just about $5.5M to non-spouse U.S. citizens free from federal estate tax. This exemption amount is called the unified credit. For 2018, the unified credit increased to $11.2M per person. For 2019, it increased again to $11.4M per person.

The annual gift tax exclusion increased in 2018 to $15,000. The amount of money you can give to another person will remain at $15,000 in 2019.

Section 529 Plans

Section 529 plans are commonly known as college savings accounts. Generally speaking, you could make contributions to the plans and have the account grow tax-free. So long as the money is used for qualified, post-secondary education expenses (room, board, and tuition), the money is never taxed. They are excellent planning tools due to this very tax-favorable provision. Under TCJA, the definition of what is a permitted qualified expense is expanded to include private school K-12 tuition expenses up to $10,000 annually.

Qualified Business Income

The TJCA brought us something new, which is a deduction for self-employed taxpayers and small-business owners that are structured as a pass-through entity, such as an S-Corp, Partnership or LLC. The provision enables 20% of qualified business income (QBI) not to be subject to federal income taxation. This provision is extremely complex and still needing clarification from the IRS on some of the more nuanced aspects. The concept is simple in design, basically, you will not pay federal income taxes on 20% of your profits; however, the code is extremely complex.

An essential aspect to point out is there are certain trades and businesses that are limited in the ability to take the deduction. These include those that are in the fields of health, law, accounting, consulting, performing arts, athletics and financial services. The ability to take the QBI deduction for those fields is limited to an income phase-out. For individual taxpayers, the phase-out starts at an income of $157,500 and is completely eliminated if income exceeds $207,500. For married taxpayers, the phase-out starts at an income of $315,000 and is completely eliminated if income exceeds $415,000. It is important to point out that the ability to take the deduction is based on taxable income, not just your business income.

Moreover, the income limitation only applies to those taxpayers in fields that are dependent on their individual skills and reputation – pretty much anyone in the professional services industry. If you or your company is in the business of producing something, such as manufacturing, architectural design and engineering, the income limitation does not apply.

The TJCA brought about many changes for personal income tax filers going forward. The changes are quite nuanced and will impact your personal financial planning situation. A significant amount of our resources will be spent this year reviewing your situation and taking steps to enable you to best position yourself with regard to the new tax laws. One question that we have heard a lot already is whether you will be better off under the new tax law. It is difficult to say without crunching the numbers, but in many cases, we expect people to initially be paying less in federal taxes.