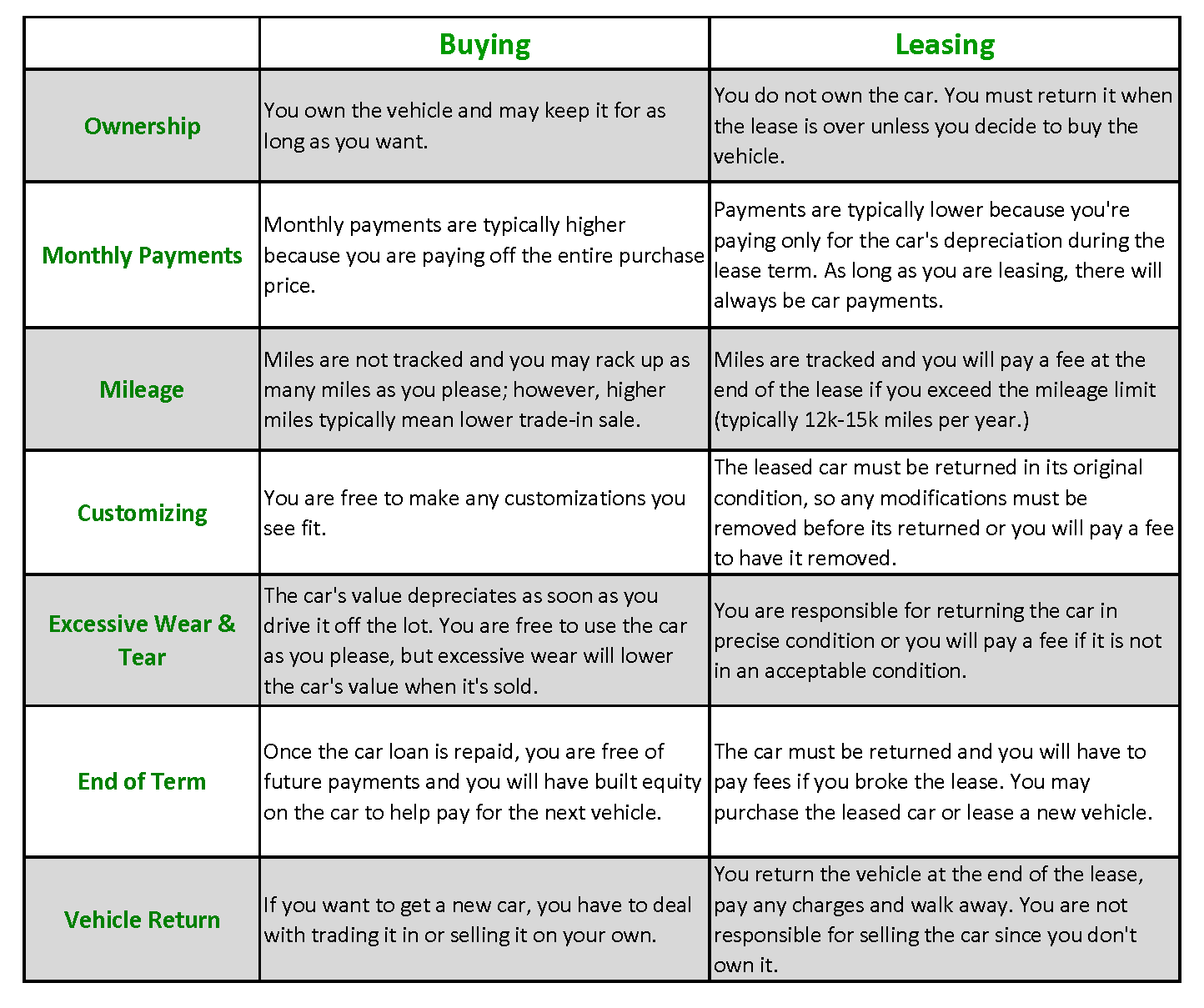

Clients often ask us whether it makes more sense to buy their next car or just lease it? The answer depends on how you plan to use the car. Here are the major differences between buying and leasing a car:

Leasing is simply a different form of financing. For example, if you want to buy a $30,000 car, and pay $5,000 for the down payment, you will need to finance $25,000. If you lease the same car, you’re paying for the vehicle’s depreciation during the lease term. In this example, if we assume the residual value is $15,000, you are only financing $10,000 over the lease period.

If you are the type of person that wants to have a newer car every few years, leasing is a great option. But be aware of some restrictions: leases generally limit how many miles you can drive during the life of the lease, typically 12,000 miles per year. If you go over the limit, you will pay a penalty, which adds up quickly. For example, if the contract stipulates $0.20 per mile over the limit, you would pay $1 for every 5 miles in excess of the limit.

Another thing to note with a lease is that you must perform all regularly scheduled maintenance on the vehicle (oil changes, tire rotations, and all recommended manufacturer maintenance). Failure to do so can result in additional fees or termination.

If you tend to drive a car for several years, put thousands of miles on it, and are not concerned about having the newest car, purchasing would be a better option. If you finance the car, you continue to build equity on a monthly basis and own the car outright at the end of the loan term. If you keep your car for eight to ten years, that could mean no car payments for four to six years – sufficient time to save up for the next car’s down payment.

When it comes to buying or leasing, there really is no one-size-fits-all solution. Many considerations need to be evaluated, and of course, cash flow and credit score will impact the final decision. If you are thinking about whether to lease or buy your next car, please contact one of our Certified Financial Planners® to see what is best for you.